FAQ

Frequently asked questions on sustainability accounting

What is sustainability accounting?

Sustainability accounting (also called True Cost Accounting, or natural & social capital accounting) is the analysis and financial evaluation of social and environmental impacts. As part of corporate sustainability management and in the wake of increasing reporting obligations, sustainability accounting is more in demand than ever.

How are sustainability accounting and sustainability reporting connected?

Sustainability reporting requirements include the assessment of financial implications of ESG risks and opportunities. Sustainability accounting can be a useful tool for calculating the monetary value of natural and social impacts and dependencies. Sustainability accounting can be used as part of double materiality assessment, as well as to communicate the costs and benefits of ESG and CSR company activities compared to economic value added.

What are the capitals of sustainability?

The capitals are typically defined as:

- Natural capital – the stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people. These benefits are called “ecosystem services”.

- Social capital – the networks of relationships among people who live and work in a particular society, enabling that society to function effectively. This includes the value added by the organization’s products, services and activities to wider communities.

- Human capital – the knowledge, skills and attributes of the workforce of others in the value chain that contribute to organizational success. As a shorthand, social and human capital are often grouped into a single category.

The creation of economic capital depends on natural capital via resource use, but also on the regulating functions of ecosystems (such as climate regulation). Social and human capital is important for business as it represents a skilled and productive workforce, but business can also have external impacts on these capitals through its activities (such as pollution).

What are impacts and dependencies?

Impacts are the external effects of business activities. They can be negative (such as the impacts of pollution) but can also be positive (such as the benefits of humus buildup for organic products). Impacts are not typically reflected in the company’s bottom line, but they can manifest as risks in the form of stakeholder pressure and fines, or as opportunities for market positioning.

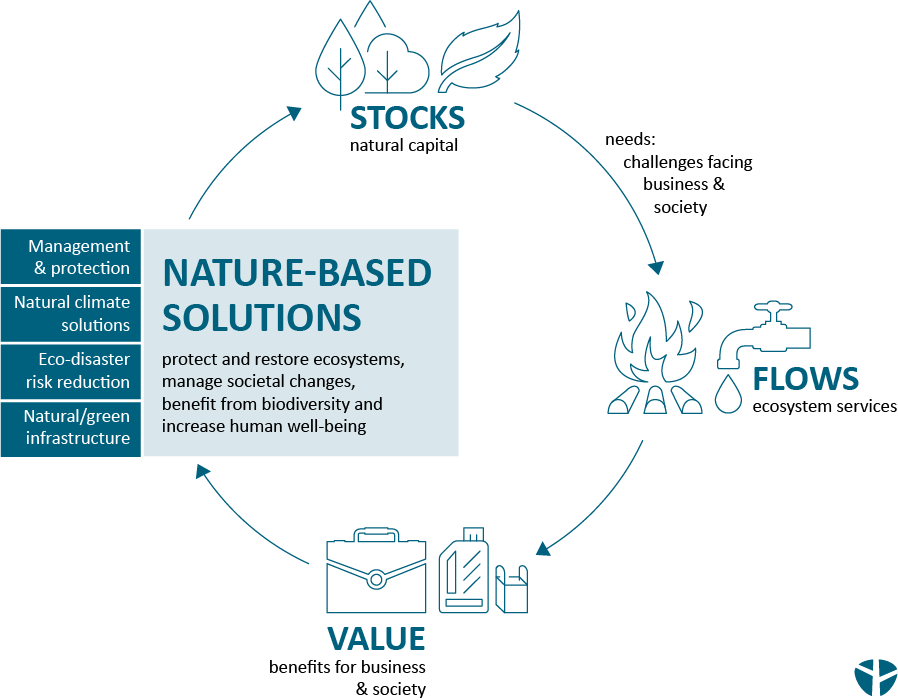

Dependencies are the internal effects of natural and social (& human) capital on business performance. These could include access to resources or skilled labour and typically have implications for the company’s bottom line. They can manifest as risks such as price increases due to resource scarcity, or as opportunities, such as investing in nature-based solutions for carbon sequestration, flood protection, water quality improvement, or the supplementation of livelihoods in the supply chain.

What is the difference between natural capital and ecosystem services?

Natural capital is the “stock” of renewable and non-renewable natural resources. Ecosystem services are the flows of benefits to society. A forest would represent natural capital stock, while the benefits of the forest – timber, carbon sequestration, etc. – would be the ecosystem services or flows of benefits.

The stocks and flows concept has important implications for sustainable resource use – if used unsustainably, the stock of natural capital may deteriorate and become insufficient for meeting societal needs and business requirements.

Why is biodiversity important in terms of sustainability accounting?

Biodiversity is an important related concept. Biodiversity underpins the ability of natural capital (ecosystems) to function and thus provide benefits (ecosystem services) to people.

How can capital thinking help us? Is monetary valuation always necessary?

“What gets measured gets managed”, or so the adage goes. Business is by design profit-driven, yet it is rarely the case that money is the only important thing for a business. Natural, social and human capital are necessary for business success, but if not measured, their ineffective management can lead to inefficient or damaging outcomes for organizations and their stakeholders.

Monetary valuation is not necessary, but it can be useful as a way of translating different material issues into a language business more easily understands and that can be directly compared and reported in line with financial parameters. This enables the integration of sustainability issues into financial planning.

Having a common metric also allows the assessment of trade-offs between different economic, environmental and social aspects of business performance.

Are there any established standards for sustainability accounting?

The Natural Capital Protocol and Social & Human Capital Protocol are the established standards for corporate assessments. In addition, there are multiple sector-specific guides, and a range of established data sources, such as the Ecosystem Services Valuation Database (ESVD) and the Global Value Exchange (GVE), as well as a wide range of scientific sources for specific issues. Feel free to reach out to us and we can help you navigate the world of natural and social capital standards and data.

How do you collect primary data?

We collect the data directly at the site level (farm, factory, stakeholder) via interviews, or by sending out questionnaires (remote & onsite).