FAQ

Frequently asked questions on biodiversity management

What is biodiversity management?

Biodiversity management addresses a company’s impact on biodiversity. Due to the threat of the extinction of species and alteration of habitats, biodiversity management is now also of regulatory relevance. For example, organizations can contribute to land use change and thus to habitat loss. Native species are displaced, and ecological systems are damaged. Biodiversity management is complex matter that requires expert knowledge in most cases.

Why is biodiversity management important?

Biodiversity management is essential for the conservation of natural habitats. We humans also depend on healthy ecosystems. Companies must therefore comply with an increasing number of legal requirements, for example in relation to reporting and making positive contributions to the preservation of biodiversity. In addition, the financial risks that the biodiversity crisis entails for companies have long been proven. This is why biodiversity management is important – for society in general and your company in particular.

How could the loss of biodiversity affect humanity?

Humanity is part of the ecosystems that are currently being affected. Any change, for example in habitats or through the displacement of native species, also has an impact on us. Every insect, like every plant, plays an important role in sensitive ecological habitats. That is why the biodiversity crisis also has a major impact on us humans.

Is biodiversity reporting mandatory?

Yes, biodiversity reporting is becoming de facto mandatory in the European Union. The EU has already released a draft biodiversity reporting standard for the Corporate Sustainability Reporting Directive (CSRD) and biodiversity criteria under the EU Taxonomy. Furthermore, EU regulation already requires financial institutions to include biodiversity reporting in the Sustainable Finance Disclosure Regulation (SFDR). CSRD Reporting is expected to become mandatory from the 1st of January 2024 with the Directive’s entry into force. Companies will be required to disclose biodiversity starting with the financial year 2023.

At the same time, the Global Reporting Initiative (GRI) will update its 2016 Biodiversity Standard, and so will SASB (under the IFRS Sustainability Disclosure Standards). The CDP questionnaire already includes a chapter on biodiversity, which will be scored from 2023 onwards. Corporate disclosure standards are emerging, such as the Task Force for Nature-Related Financial Disclosures (TNFD) and Science-Based Targets for Nature (SBTN). Biodiversity is already a required topic for standards such as EMAS.

What is the difference between biodiversity, ecosystem services and natural capital?

Biodiversity, ecosystem services and natural capital are related concepts. Ecosystem services are the flows of benefits that people obtain from nature. Natural capital is the stock of ecosystems from which these benefits flow. The quality of the natural capital stock depends on biodiversity. For example, a forest is “natural capital” from which people obtain the ecosystem service “carbon sequestration”. The ability of the forest to sequester carbon depends on how well the ecosystem functions. This functioning depends on biodiversity. Thus, biodiversity underpins the ability of ecosystems (natural capital) to function and thus provide benefits (ecosystem services) to people and businesses.

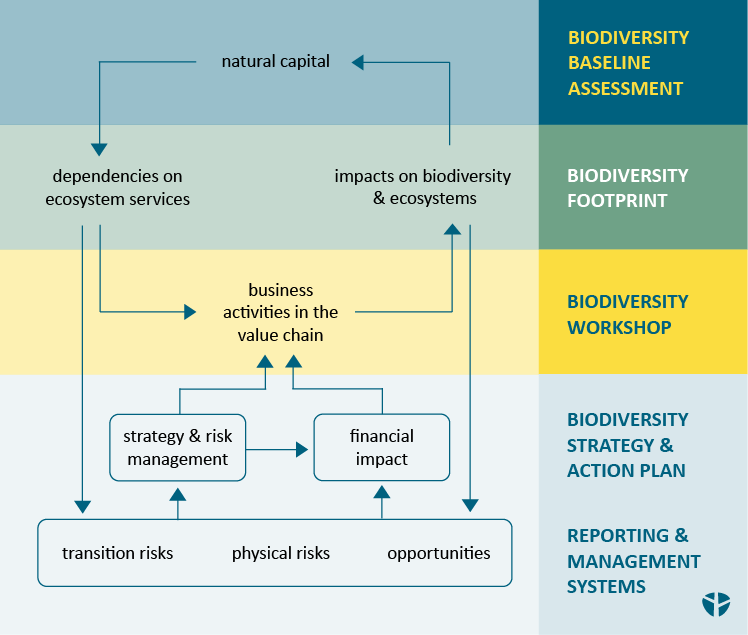

What are biodiversity impacts and dependencies?

Impacts and dependencies are concepts from the Natural Capital Protocol and refer to the two ways business activities are linked to biodiversity. Business activities cause impacts on biodiversity through emissions and unsustainable resource use. At the same time, businesses depend on the ecosystem services that nature provides (such as access to resources or protection from extreme events).

These impacts and dependencies can lead to biodiversity-related risks and opportunities. The Task Force for Nature-Related Financial Disclosures (TCFD) defines three types of biodiversity risks for businesses:

- Physical risks – resulting directly from business dependencies on nature. These risks manifest when ecosystem functioning is compromised and thus unable to provide ecosystem services.

- Transition risks – resulting from changes in the market environment, such as policies, regulations, litigation, technological developments or changing consumer preferences aimed at halting or reversing damage to nature.

- Systemic risks – this is an extension of TCFD risks thinking and arises from a systemic breakdown of ecosystem functioning. An example can be the loss of a key species on which the functioning of an entire ecosystem depends.

- Businesses can and should measure biodiversity impacts and dependencies to understand risks and opportunities and formulate actionable biodiversity strategies that support long-term financial success.

What biodiversity topics are relevant to my business?

Biodiversity is a multi-topic issue, as illustrated by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES). IPBES identifies 5 main biodiversity loss drivers – land (and sea) use change, the direct exploitation of organisms, climate change, pollution, and invasive species. The Science-Based Targets for Nature network (SBTN) groups biodiversity targets into 5 categories:

land use, freshwater use, oceanic resources use, climate & the land sector, and ecosystem integrity.

Not all topics are equally relevant for every business. Thus, the first step of a biodiversity strategy is conducting a materiality assessment to determine which topics are relevant for priority focus. A materiality assessment should cover both impacts and dependencies on biodiversity to assess and disclose risks and opportunities. At the same time, biodiversity is also a location-specific issue. Thus, it is advisable to use materiality assessment to establish not just priority topics, but also priority products, locations, or supply chains.

How is biodiversity measured?

What is biodiversity net gain and how is it different from no net loss biodiversity?

A “no net loss” biodiversity target means that any negative impact on biodiversity is balanced by measures taken to avoid and minimize the impacts, to restore affected ecosystems, and finally to offset any residual impacts. A “net gain” target is one where the positive impact on biodiversity through restoration and offsetting exceeds negative impacts. Crucially, achieving a biodiversity target requires adhering to the mitigation hierarchy – avoid and minimize impacts, restore affected ecosystems, and finally offset any residual impacts.

How do you set a Science-Based Target for Nature?

The SBTN standard follows a 5-step process:

- Assess: Gathering and supplementing existing data to estimate the impacts and dependencies on nature in the value chain. The result is a list of potential topics and locations for setting a target. Your organization may already be managing some biodiversity issues (e.g. greenhouse gas emissions (GHG), water use, or deforestation). This first step will highlight what you are missing.

- Prioritize: Based on the results from step 1, a materiality assessment analysis can help you prioritize where to focus your efforts.

- Measure: You will need to gather the necessary data for your target baseline. You may need to enhance existing data collection processes or set up additional data collection where necessary.

- Act: Once you have the necessary data, a plan of action will need to be developed to meet your target, following the Mitigation Hierarchy – avoid, reduce, restore, and offset impacts.

- Track: Finally, you will need to have a process in place to monitor your progress, as well as to incrementally improve your data collection and impact assessment over time.

SBTN envisions separate target-setting methodologies for its 5 priority issues influencing biodiversity – land use, freshwater use, oceanic resources use, climate & the land sector, and ecosystem integrity. These methodologies are currently being developed. Companies can already set interim targets which allow you to get started and will count toward a full target once methodologies become available.

How do you measure nature-related risks and opportunities for TNFD?

The Task Force for Nature-Related Financial Disclosures (TNFD) is an initiative similar to TCFD, meaning that it is not just about measuring, but also incorporating nature-related matters into company governance, strategy, risk management, metrics, and targets. The core of TNFD is the LEAP approach. Companies will need to:

- Locate where their business activities overlap with nature. A biodiversity baseline assessment can be a useful analysis to undertake for companies’ operations, while a biodiversity footprint can help with identifying supply chain issues.

- Evaluate priority dependencies and impacts. Not everything that is identified, assessed, and evaluated using the LEAP approach needs to be disclosed. Materiality analysis can be a useful tool to prioritize what to focus on.

- Assess material risks and opportunities. A deep dive into priority topics and locations should be carried out to establish how they can potentially influence business performance. Current corporate policies, processes, and management approaches should be evaluated to establish their adequacy for handling biodiversity-related risks and opportunities. These should be supplemented or new processes should be developed where gaps are identified.

- Prepare for external disclosure. Potential biodiversity impacts on corporate strategy should be identified and resources allocated if necessary for management. Relevant metrics and KPIs should be selected, and biodiversity targets should potentially be developed. Target-setting approaches for biodiversity are still in the development stage.

The TNFD framework is still under development and is expected to be released in 2024. Companies can trial the framework in the interim and start preparing for future disclosure. The requirements of TNFD are strongly in line with the draft biodiversity disclosure requirements of the Corporate Sustainability Reporting Directive (CSRD).

How can financial institutions measure biodiversity?

Financial institutions can measure their impact on biodiversity using the biodiversity footprint methodology. The applicable standard is PBAF (Partnership for Biodiversity Accounting Financials) – a sister initiative of PCAF (the Partnership for Carbon Accounting Financials). Carbon and biodiversity footprints are similar but also different – a biodiversity footprint focuses on the different drivers of biodiversity loss, which include climate (and GHG emissions), but also other topics (such as land and water use, and pollution). As with PCAF, primary data for portfolio companies’ activities gives the most detailed results, but recognizing its limited availability, using secondary data is also permitted.

Our experts are familiar with all the necessary tools for applying PBAF to companies, including EXIOBASE, IBAT, ENCORE and Life Cycle Assessment (LCA) methodologies.